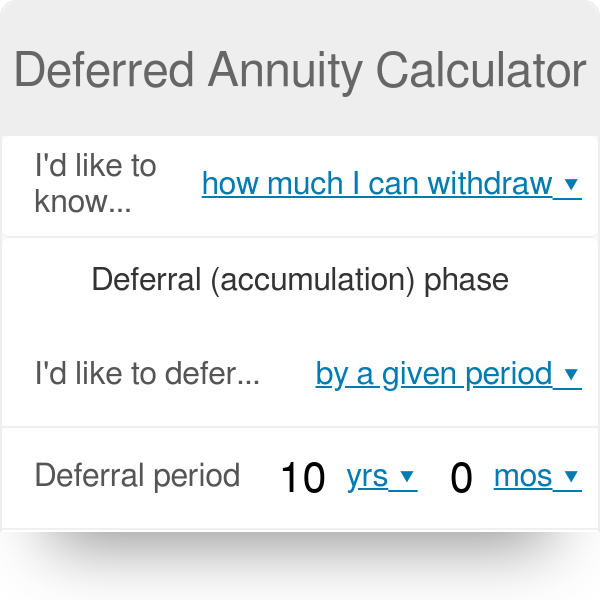

Tax deferred annuity calculator

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Annuities can be classified by the frequency of payment dates.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

Calculating Present And Future Value Of Annuities

Assets in a tax-qualified retirement plan already enjoy tax deferral.

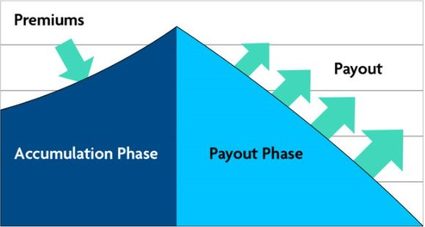

. A Deferred Annuity is a single-premium annuity which grows at a fixed rate for a predetermined amount of time very similar to CDs. The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. Growth is tax deferred.

Fixed rate that does not change until the end of the annuity contract. Furthermore this tool does not ensure the availability of or your eligibility for any specific product. A deferred annuity is an insurance contract that generates income for retirement.

Deferred annuities take years to payout as the tax-free annuity grows with interest. Once the annuitization or distribution phase begins again based on the terms of your. Should your financial needs change you can.

Annuity payment options depend on the type of annuity purchased. Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account. Applicable Tax Rate for Super Senior Citizen 80 years or above Up to 3 Lakh.

The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home. Regardless if its a fied or variable your princiapl is protected. After that interest rates may be adjusted each year.

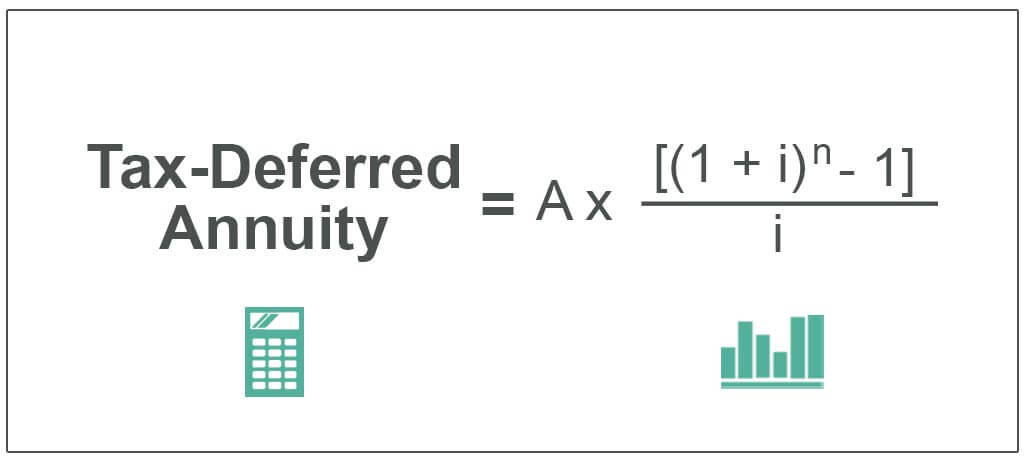

Earnings in annuities grow and compound tax-deferred which means that the payment of taxes is reserved for a. Annuity Rates Quotes Multi-Year Guarantee Annuities MYGA Share. By following annuity rules earnings will accumulate on a tax-deferred basis until withdrawals are ready to be made.

An annuity is a series of payments made at equal intervals. And amount to invest in our Annuity Quote Calculator and click the Get My Quote button. A 1035 Exchange taken from the Internal Revenue Code section of the same number is an IRS provision in the tax code that allows policyholders to transfer funds from a life insurance plan endowment or annuity to.

It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they are withdrawn from the account. Fixed deferred annuities also provide you with a guaranteed minimum interest rate regardless of market conditions. In essence when you buy a deferred annuity you pay a premium to the insurance company.

Immediate annuities can payout within a year of purchase. That initial investment will grow tax-deferred throughout the accumulation phase typically anywhere from ten to 30 years based on the terms of your contract. The payments deposits may be made weekly monthly quarterly yearly or at any other regular.

It is always a good idea to consult your tax legal and financial advisors regarding your specific situation. Your quote will appear instantly on the next page. Compare the 3- 5- and 10-year Fixed Guaranteed Growth Annuities.

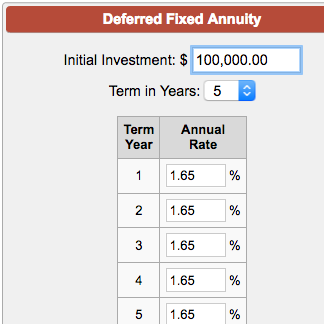

With a fixed deferred annuity a guaranteed interest rate is locked in for an initial period. Get income annuity quotes using the annuity calculator on this page or call. Use this calculator to help you determine how a Fixed Annuity might fit into your retirement plan.

Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments. Payout schedules determine the. This permits earnings on premiums to avoid income taxation until distribution.

If taxes are a concern a fixed deferred annuity may be a better option. In addition to being protected against it promises a minimum monthly payment. Therefore a tax deferred annuity or fixed deferred annuity.

In exchange for one-time or recurring deposits held for at least a year an annuity company provides incremental. Deferred Annuity Calculator See note 1. The advantages of a tax-deferred annuity.

Tax deferred growth is arguably the most appealing feature of a non-qualified annuity. As is the case for most annuities a tax-deferred annuity can provide income for the remainder of an individuals life life. 01 Flexibility for the future.

Just plug in the amount of the loan your current home value the interest rate the length of the loan any points or closing costs and your annual taxes insurance and PMI. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. A Fixed Annuity can provide a very secure tax-deferred investment.

Also known as fixed-rate or CD-type annuities Multi-Year Guarantee Annuities MYGA provide a predetermined and contractually guaranteed interest rate for a set period of time typically 3-10 years. Annuity calculator - Calculate the annuity value of different types of annuities such as immediate annuity deferred annuity fixed annuity etc.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities6-f3e0ae90db8b4a5398e3fcabd0538a92.png)

Calculating Present And Future Value Of Annuities

Split Annuity Strategy Weinberg Financial Group

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

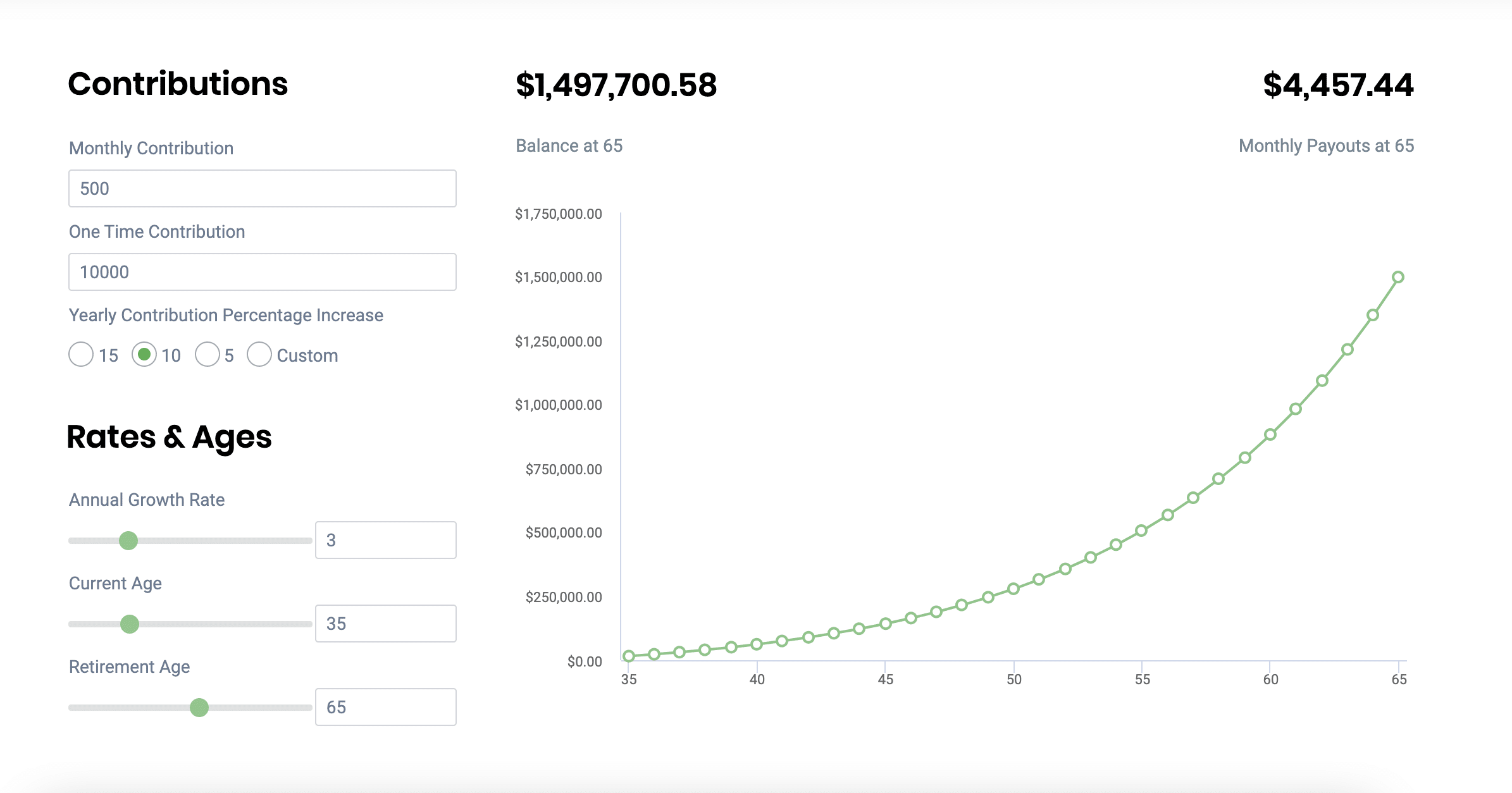

The Best Annuity Calculator 17 Retirement Planning Tools

Annuity Calculator Due

Deferred Fixed Annuity Calculator

Annuity Calculator

X Bmj4zuzopyum

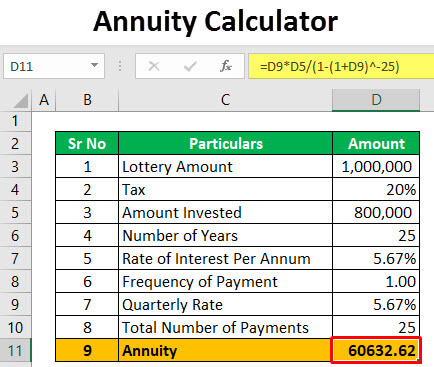

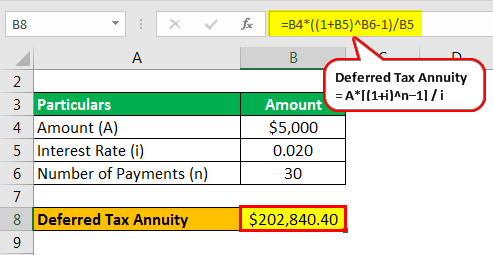

Tax Deferred Annuity Definition Formula Examples With Calculations

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Deferred Annuity Calculator

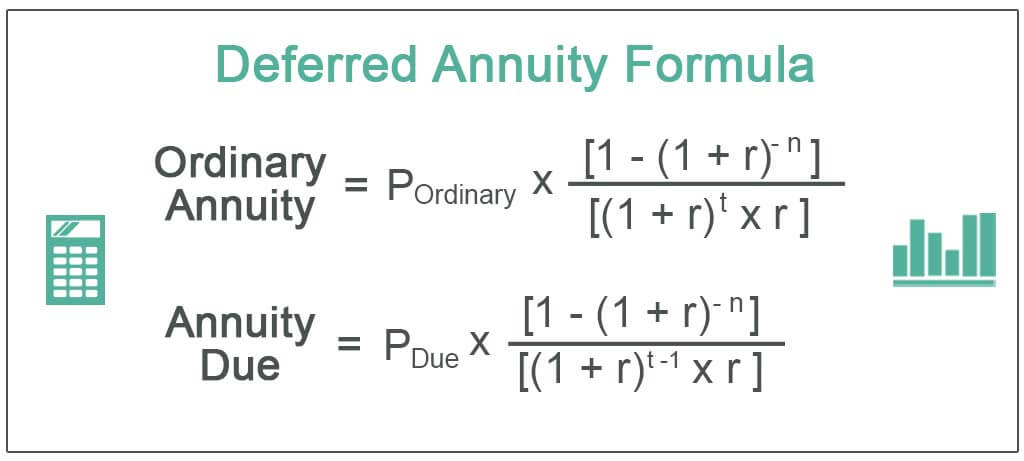

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

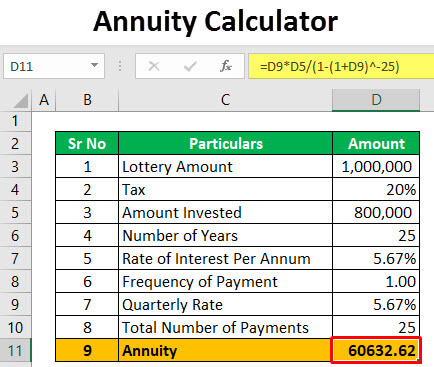

Annuity Calculator Examples To Calculate Annuity

Deferred Annuity Calculator

Tax Deferred Annuity Definition Formula Examples With Calculations

Personal Balance Sheet How To Create A Personal Balance Sheet Download This Personal Balance Sheet T Balance Sheet Template Balance Sheet Worksheet Template

Annuity Calculator Due